Balance Sheet Definition & Examples Assets = Liabilities + Equity

Content

For example, one https://intuit-payroll.org/ liability that should be paid within the fiscal period is the salary due to employees. Because employees typically receive their payment within the month in which they worked, these payroll expenses would be considered current liabilities. Examples of noncurrent liabilities include taxes or loans that are to be paid in increments and are not yet due within a current fiscal period.

- Companies may also choose to prepare balance sheets on a monthly basis, in which case they would report on the last day of each month.

- This account is derived from the debt schedule, which outlines all of the company’s outstanding debt, the interest expense, and the principal repayment for every period.

- Assets can be further broken down into current assets and non-current assets.

When valuing your A Beginners Guide To The Types Of Liabilities On A Balance Sheet , you can opt for the market approach, which equals the current market value, or you can choose the cost approach, which equates to the original cost of the item. Assets are the properties owned by the business, which usually are used in production but may be sold at any point. Assets can be either tangible, such as equipment, supplies, and inventory, or intangible, such as intellectual property.

Let’s find your next accountant.

Commercial paper is a form of short-term debt with a specific purpose that is different from long-term debt. In fact, the 3-statement model of Apple we build in our Financial Statement Modeling course treats the commercial paper like a revolving credit facility (i.e. the “revolver”). To abide by general financial modeling best practices, the hardcoded inputs are entered in blue font, while the calculations (i.e. the ending total for each section) are in black font. The balance sheet of the global consumer electronics and software company, Apple , for the fiscal year ending 2021 is shown below. Retained Earnings Retained earnings represent the cumulative amount of earnings kept by a company to date since the date of formation, i.e. the remaining profits not issued as dividends to compensate shareholders. Deferred RevenueDeferred revenue, i.e. “unearned revenue”, represents customer payments received by a company in advance for goods or services not yet delivered. Current Assets → The assets that can or are expected to be converted into cash within one year.

What are the types of liabilities in balance sheet?

Liabilities can be classified into three categories: current, non-current and contingent.

Efficiency – By using the income statement in connection with the balance sheet, it’s possible to assess how efficiently a company uses its assets. For example, dividing revenue by the average total assets produces the Asset Turnover Ratio to indicate how efficiently the company turns assets into revenue.

Identify liabilities

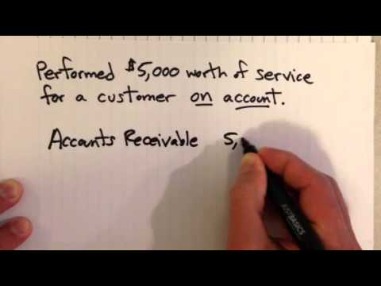

On the balance sheet, assets equal liabilities plus shareholders’ equity. You’ll want your balance sheet to include this calculation to provide insights into your financials.

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. We already explained assets, liabilities, and stockholder’s equity. The balance sheet must always “balance” because assets equal liabilities plus equity . Understanding this equation helps you understand a company’s position. If the company has more liabilities than assets, then it will have negative equity, which is a potential major red flag especially with mature businesses. You’ve probably heard people banter around phrases like “P/E ratio,” “current ratio” and “operating margin.” But what do these terms mean and why don’t they show up on financial statements?

What’s the Difference Between Assets and Liabilities?

A P&L report summarizes the aggregate impact of revenue, gain, expense, and loss transactions over a specified period. The document can be used to derive various financial trends, business activities, and important comparisons over successive time periods. You’ll often find P&L reports included with quarterly and annual reports. Financial statements are the tools that any entrepreneur will use to judge a company’s overall performance. Once you’re able to understand them, you’ll be able to make informed decisions to help you expand the business, improve your profit, and catch any problems before they get out of hand. You should think of the due diligence process as an important step in your career, just as much as acquiring and operating a business is a part of your career. Now, more than ever, investors, shareholders, banks, and revenue services require higher accountability from business owners.

- Liability can be used for purchasing necessary equipment or buying computer systems.

- Companies spread the cost of these assets over the periods they are used.

- Each of the three financial statements has an interplay of information.